My Personal Financial Strategy

I’ve always been fascinated by money: how people earn it, spend it, and invest it. What fascinates me most about personal finance is how personal it is. Everyone has different goals and desires, and everyone has to pick and choose what to do with the limited resources they have.

When I turned 24 (I’m 31 today at the time of me writing this) I took a serious look at my finances and decided to get my act together. Up until that point I had only a vague idea that I wanted to have a lot of money someday, but I had no real strategy or plan and had essentially no knowledge whatsoever about managing finances. Since then I’ve read a number of books, blogs, and articles as well as listened to thousands of podcast episodes and watched hundreds of YouTube videos on the subject.

Today I’m going to outline the personal financial strategy that my wife and I follow in hopes that it inspires you to give a bit more thought and consideration to your own personal financial strategy. I’m not saying our approach is perfect (it certainly isn’t), but I believe sharing information like this can be motivating and educational.

For the sake of transparency, everything I’ve outlined below is exactly what we do with our money. We have a substantial amount of money invested exactly as described and allocated below.

Financial Goals

The most important part of building a personal financial strategy is deciding what your goals are.

If your goal is to have 10 million dollars, that’s fine – but it means that you’re going to have to make dramatically different day-to-day decisions than you would if your goal is to save 100k.

Regardless of your circumstances, coming up with an explicit goal is, without question, the most important thing you’ll ever do financially. I can’t overstate this enough.

If you have an explicit financial goal (e.g., save 100k over the next year), you can easily figure out what you need to do to hit it (e.g., save 8.3k per month). After that, all you need to do is execute the plan! It may not be easy, but at least you’ll have something to work towards and a crystal clear idea of whether or not you’re on track.

My financial goals over the years have fluctuated quite a lot.

- When I first left university, my goal was to pay off my student loans

- When I first bought a car, my goal was to pay off my car loan

- When I decided to get married, my goal was to pay for the ring and wedding

- When I moved into my first apartment, my goal was not to live paycheck to paycheck any longer

- When I started working my first real job, my goal was to put a certain amount of money into retirement

- When I bought my first house, my goal was to pay it off

- Etc.

As my wife and I have learned more and become more sophisticated in managing our finances, our goals have changed considerably.

Today, our financial goals are quite a bit different:

- Save 100% of our earned income (the money that my wife and I earn from our day jobs)

- Max out all retirement accounts

- Save enough so we can passively withdraw up to 10x our lifestyle expenses each year

We’ve been fortunate enough to be able to accomplish items #1 and #2 for several years now and are steadily working towards #3.

I’ve found that, in particular, setting goals around your total debt (how much money you owe to other people), savings rate (what percentage of money are you able to save from your income each year), net worth (how much are you worth taking all of your assets and liabilities into account), and safe withdrawal rate (how much money can you safely withdraw from your portfolio every year without dwindling your principal) are very motivating.

For example, if you’re just starting to pay attention to your finances and have some debt, a good first goal might be to reduce your debt from 100k to 50k. If you’re past that phase of life, maybe a good goal would be to save 15% of your take-home pay.

If you’re further along in your savings journey, setting goals around your net worth (e.g., I want to increase my net worth by 50k) or your safe withdrawal rate (e.g., I want to be able to safely withdraw 1k per month from my investments, indefinitely) can be fun as well.

The farther along you are and the more money you’ve saved, the more interesting your goals become.

Financial Priorities

Once your goals are in place, you have to organize them by priority. This is my favorite part!

Here’s what my list of financial priorities looks like, in order of importance:

- Create and stick to a realistic monthly budget

- Pay off all consumer debt (cars, etc.)

- Pay off all non-consumer, non-mortgage debt (student loans, medical expenses, etc.)

- Save an emergency fund of 1 year’s worth of expenses

- Pay off all mortgage debt (primary residence)

- Invest as much income as possible, split equally between real estate and index funds (more on this later)

As you can probably tell from the list above, we’re pretty conservative with money. I really hate having debt, so my priority has almost always been to be free and clear of all debt, even if that meant investing less money and having less liquid assets.

If you’re less conservative with your money choices, maybe you wouldn’t mind keeping mortgage debt around, for example. Maybe you would instead prefer to invest the extra money you have instead of paying down a mortgage. These types of choices are all fine, there is no right or wrong way to do it; it really just comes down to your values: what do you care about most?

One tip I have for figuring out how to prioritize your financial goals is this: try to diversify your risk. In my professional career, I’ve taken a lot of risks: running my own companies, working at startups, and putting myself into very volatile positions that are high-risk, high-reward. Because of this, I’ve strategically decided to be conservative with my money to balance my overall risk portfolio.

If you’re in a less risky career path, maybe you can afford to be more aggressive with your financial plans: keep debt around longer, focus more on high-growth investments, etc.

Budget

After setting goals, having a budget is the next most important thing in a financial plan. If you don’t know how much money you’re spending and set some guidelines around how much you’re going to spend, you’re in trouble.

If you don’t track your money already, I highly recommend signing up for a free account at mint. It lets you sync all of your financial information across bank accounts, loan accounts, credit card accounts, etc., as well as build budgets and see how you’re doing. I use it almost every day.

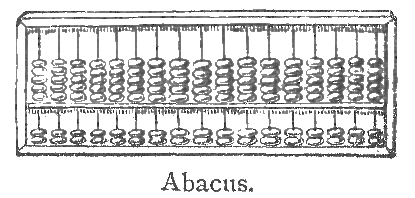

Here’s what our monthly budget looks like today:

There are two additional things that aren’t included in this image: the amount we spend on taxes and insurance for our home and a bit of money we set aside each month for future home upgrades/repairs. All together, our monthly budget allocates $4,000 for spending.

While I don’t think we’ve ever hit exactly the 4k mark, we’re always somewhere near this number: a little lower or a little higher, depending on how each month goes. Last month, for example, we spent a little more on shopping as my wife and I purchased gifts around the holiday. Next month we’ll spend a little less on shopping to make up for it.

The most important thing is knowing where your money is going and making conscious decisions about what you value and where you want to allocate your resources. Not paying attention to what you do with your money is the number one reason people don’t reach their financial goals.

Side Story: When I first left university and got married, my wife and I didn’t really track our spending. After the first year or two of marriage we had paid off all our debt (which was mostly my car and student loans), but once the debt was gone, neither of us talked about budgeting or what we wanted to do with our money. We basically just lived our lives without thinking about money.

After a couple of years of this I remember logging into mint and looking at our net worth. Over a timespan of 2 or so years, our net worth hadn’t gone up at all. It had essentially stayed around the ~10k range.

At first, I was really confused. Both of us were working full-time and earning reasonable amounts of money for young people fresh out of school – why didn’t we have more money? After digging into where the money went (thanks mint!), I came to the scary realization that because we hadn’t planned what we wanted to do with our money: we ended up blowing it on insignificant things.

We hadn’t spent a lot of money on any one thing – it was a combination of small things that got us. Going out for too many fancy dinners, buying a few too many new electronics, purchasing more gifts for our friends and family, etc.

What I learned that day scared me: we had worked ~2 full years of our life (in our prime!) and had literally nothing to show for it. All that hard work had gone to purchase frivolous stuff that we couldn’t even remember!

This was the moment that really made me understand how important it is to have a plan for your money. The thought of going to work every day, pushing myself to be my best, and pouring my heart and soul into my passion, all while essentially getting no reward was terrifying.

Debt (Or a Lack Thereof)

![Grim Reaper in Bed Sketch][]

I mentioned this above, but I really dislike having debt. I really enjoy the freedom that comes with not having to worry about making payments to someone else every month. Keeping my recurring monthly expenses low makes me feel stress-free, and that’s something I value highly.

Early on in my life, I made a lot of dumb financial decisions. I took on a massive amount of student loan debt, purchased a new car with financing, and routinely spent all (or almost all) of my income every month, frivolously.

When I first started tracking my finances and net worth and saw how low my net worth was (-100k or so), I immediately got serious about paying off my debt. I spent the first few years of my professional life living frugally and putting as much money towards my debt as possible.

It was really motivating for me to knock off my smaller student loans (5k here, 7k there), and watch my monthly commitments drop down to zero.

A few years ago, when Sami and I decided to purchase a house for the first time, the biggest driving force I had was to stop shelling out money in rent every month, as every year our rent would increase and our monthly commitments would grow.

Initially, we purchased our home on a 30-year fixed mortgage, as I figured that way I’d be able to lock in a monthly housing payment every month. My thought process at the time was that it was better to have a fixed housing payment as opposed to a variable amount of rent. Our plan at the time was to make the minimum monthly payments for 30 years and invest all our spare money each month.

Unfortunately, it wasn’t long after we purchased the house that I realized we had made a mistake: the thought of having a large mortgage payment every month for the next 30 years made me feel really stressed, so we decided to allocate our resources towards paying it off instead. It was a hard decision, but just before the 2-year mark of owning our home we made the final payment and wiped the mortgage out of our lives.

NOTE: Leading up to us paying our home off, we sold a car, cut back on spending, tightened our budget up, and poured huge amounts of money into paying down the home loan as quickly as possible. I realize this isn’t possible for everyone, but the concepts are still relevant, even if it takes you longer to make it happen.

While many people keep a mortgage for as long as possible and invest their spare cash, I find it more rewarding (and less risky) to pay off the debt, even if it’s at a relatively low, fixed rate. For me, the benefits of not having any payments greatly outweighs the drawbacks of having reduced liquidity and more invested assets.

Regardless of your stance on debt, figuring out what types (and the amount) of debt you’re comfortable with is an important step in developing a financial plan. If you’re on the fence about whether or not to buy a car and take out a big loan, for example, thinking through how comfortable you are incurring increased monthly commitments is a great way to align yourself with your goals.

Investing

![Rich Skeleton Sketch][]

I started investing when I turned 24 and started paying closer attention to my personal finances. When I first got started, I had no idea what I was doing, but through lots of books, podcasts, online blogs, forums, and YouTube videos, I slowly developed the investing strategy that my wife and I follow today.

Our strategy today is simple: we split our investable money into two asset classes: real estate and index funds. Our goal is to invest in each of these asset classes equally, but for reasons I’ll explain momentarily, we haven’t yet been able to achieve that.

NOTE: If you aren’t familiar with the concept of index funds, I’ll explain it briefly: index funds are funds which allow you to purchase a little bit of every company in a given index. For example, you can buy a little bit of every company in the US stock market. Index fund investing has been shown to outperform more expensive, actively managed funds, in almost every scenario. If you’d like to learn more, this article is a great, brief introduction.

Out of the 50% of our money that is invested in index funds, our allocation is as follows:

- 70% VTSAX (total stock market index fund, USA)

- 25% VTIAX (total stock market index fund, international)

- 5% VCADX (California tax-exempt municipal bond index fund)

The above allocation is quite aggressive: 95% of our allocation here goes towards stock funds (which are generally volatile) while only 5% of our money is allocated towards relatively safe, lower-yielding municipal bonds.

We’ve got 70% allocated towards the US stock market because that’s where we live, and historically, the US stock market has averaged a relatively high rate of growth. We’ve got 25% allocated towards the international markets to help reduce volatility in our US stock portfolio, as well as to capture growth in non-US markets. Finally, we’ve got 5% of our money in tax-exempt California bonds because we live in California, are in a relatively high tax bracket, and want to invest a little of our money in the state where we live and grew up.

We don’t have any money allocated towards alternative investments like precious metals as those items are purely speculative. I am of the opinion that investing in assets that produce value (companies, loans, etc.) will, in the long run, pay off more than simply hoping that someone else values a piece of metal more in a few years than they do now.

We also don’t have any money invested in single stocks as that’s a bit too risky for our tastes. I dislike the thought of having a large amount of money tied up in any single company – what happens if that company makes poor decisions or has a massive problem (like Boeing with their 737 MAX 8)? Having our money bound to a single company’s future is far too risky for us.

In regards to real estate, we own a small portfolio of single-family houses that we rent out via a property management company. These houses are all fully-owned (they have no mortgages). They provide a steady stream of rent payments and provide a base-level of passive income that my wife and I use to cover our living expenses each month.

One of the reasons we try to split our investments between index funds and real estate is that, while owning index funds is generally going to make more money in the long run (and is also far simpler and less time consuming), I enjoy the real estate industry as well as the stability that comes with it.

While stock values might swing wildly from day to day, a tenant’s rental agreement will rarely change. In our case, the homes we own provide a reliable source of consistent income that gives us a certain level of comfort.

In addition to the consistency of real estate returns, one of the other reasons we put money into physical real estate is that, as an investor, you can often find good deals on real estate purchases. While it’s essentially impossible to find a good deal on a company’s stock, there are tons of great bargains to be had in the real estate market at any given time.

For various reasons, real estate can be an attractive investment:

- You can often pay less for a property than it is worth

- You can purchase a property in poor condition, fix it up, and add value to it that wasn’t there before

- You can purchase real estate that isn’t performing well and make it perform better through renovations, improved management, etc.

- There are various tax advantages to owning real estate which don’t exist for other types of investments

In all of these scenarios, you’re able to improve your returns by putting in some effort – something that’s essentially impossible to do with stock market investments.

Unfortunately, however, because purchasing real estate takes a lot of knowledge, effort, and time: it’s been difficult to balance our portfolio towards our desired 50/50 ratio. The way we’re handling this at the moment is to simply keep investing excess money in index funds until we find suitable properties to purchase, at which point we’ll simply liquidate some of our holdings and make a purchase, thereby getting us closer to the 50/50 ratio we’re aiming for.

Retirement

![Skeleton Praying Sketch][]

While I’ve already shared our specific financial strategies, one thing I haven’t yet covered is how we optimize our retirement investing. In the US, there are several ways you can invest money in tax-advantaged accounts.

FIrst of all, let’s talk about IRAs (individual retirement accounts). In 2020 (the year I’m writing this article), you’re allowed to contribute up to 6k per year into a Roth IRA account (7k if you’re 50 or older). Money invested in a Roth IRA account will grow tax-free, and whenever you retire, that money can be withdrawn from the account tax-free as well.

To take advantage of the Roth IRA, every year towards the end of the year we set aside 12k so that on January 1st we can each contribute 6k to a traditional IRA account, which we later convert into a Roth IRA to bypass the income qualification limits. This is known as the backdoor Roth. This gives us 12k per year of tax-advantaged investments.

Next, there’s the 401k. 401k plans allow you to stock away up to 57k worth of money for retirement each year (63.5k if you’re 50 or older) with various types of tax advantages.

Because my wife and I are both full-time employees of companies, and because our companies have 401k plans that allow us to contribute to all the different types of 401k accounts, we max our 401ks out each year by first contributing 19.5k each to our traditional 401k accounts (the max limit in 2020 for people less than 50 years old). After that, we contribute the remaining 37.5k into an after-tax 401k account (which does not have any tax advantages), which we then instantly convert into a Roth 401k account (which means that our money will grow tax-free and we’ll be able to withdraw it tax-free when we retire). This strategy is often referred to as the Mega Backdoor Roth.

This gives us 114k per year of tax-advantaged investments.

I also own a consulting business where I occasionally do consulting work around the telephony, web security, and developer services industries. Because I run this company as a business, I’m also able to invest a portion of my net profits into a SEP-IRA (a special type of retirement account for small businesses). This plan allows me to stock away an additional 57k worth of tax-advantaged money each year.

All in all, we’re able to make a total of $183,000 worth of tax-advantaged contributions each year into our retirement accounts. That is a massive amount of tax-optimized investments.

And while you may not have a ton of money to throw into retirement accounts, I strongly suggest that with whatever earned income you do have available to save, you invest it into tax-advantaged retirement accounts before you do any additional (non-retirement) investing.

By prioritizing tax-advantaged retirement accounts you’ll reduce your tax burden each year and get more out of your investments in the long run.

Resource Allocation

![Skeleton Hand with Money Sketch][]

The last thing I want to discuss about my personal financial strategy is resource allocation. Nobody has unlimited resources. Even Jeff Bezos and Bill Gates have to decide where to allocate their time and money.

One of the most impactful things you can do to help get your finances in order is to determine what’s important to you, then invest in that. For example, if your passion in life is biking, maybe allocating a large chunk of your take-home pay for biking gear makes sense. While it would be silly for me to spend a large chunk of my take-home pay on biking gear, if it’s something important to you, that money isn’t being wasted.

In my case, I spend a lot of money on technology. I’m a programmer and am completely obsessed with technology, so while I spend almost no money on other hobbies or projects, I do end up purchasing one or two new devices every year to play around with. I also spend a lot of money on hobby software projects: domains, web hosting, etc. These things keep me happy and are what I save money for.

Investing shouldn’t be the goal, it should simply be a means to an end. Investing allows you to do more of the things you value.

My Financial Strategy Summarized

![Jack Skellington with Pumpkin Sketch][]

If I had to summarize my personal financial strategy, it would be:

- Work hard

- Don’t go into debt

- Save and invest as much money as possible

- But don’t be afraid to spend money on the things you care about most

Anyhow, I hope this has been interesting to you. Managing your finances can be fun, and in many ways liberating.

Putting together a financial plan for yourself can be a great way to force tough conversations and help you figure out what it is you value. I know that for me, learning a bit about personal finance changed my life dramatically for the better. If you haven’t sat down and developed a personal financial plan – go do it!

[Grim Reaper in Bed Sketch]: /static/images/2020/grim-reaper-in-bed-sketch.jpg “Grim Reaper in Bed Sketch”" [Rich Skeleton Sketch]: /static/images/2020/rich-skeleton-sketch.jpg “Rich Skeleton Sketch”" [Skeleton Praying Sketch]: /static/images/2020/skeleton-praying-sketch.jpg “Skeleton Praying Sketch”" [Skeleton Hand with Money Sketch]: /static/images/2020/skeleton-hand-with-money-sketch.png “Skeleton Hand with Money Sketch”" [Jack Skellington with Pumpkin Sketch]: /static/images/2020/jack-skellington-with-pumpkin-sketch.jpg “Jack Skellington with Pumpkin Sketch”"

PS: If you read this far, you might want to follow me on Bluesky or GitHub and subscribe via RSS or email below (I'll email you new articles when I publish them).